Despite flatfair Deposits being relatively new, the growth in demand has been substantial, particularly in the Build to Rent (BTR) sector.

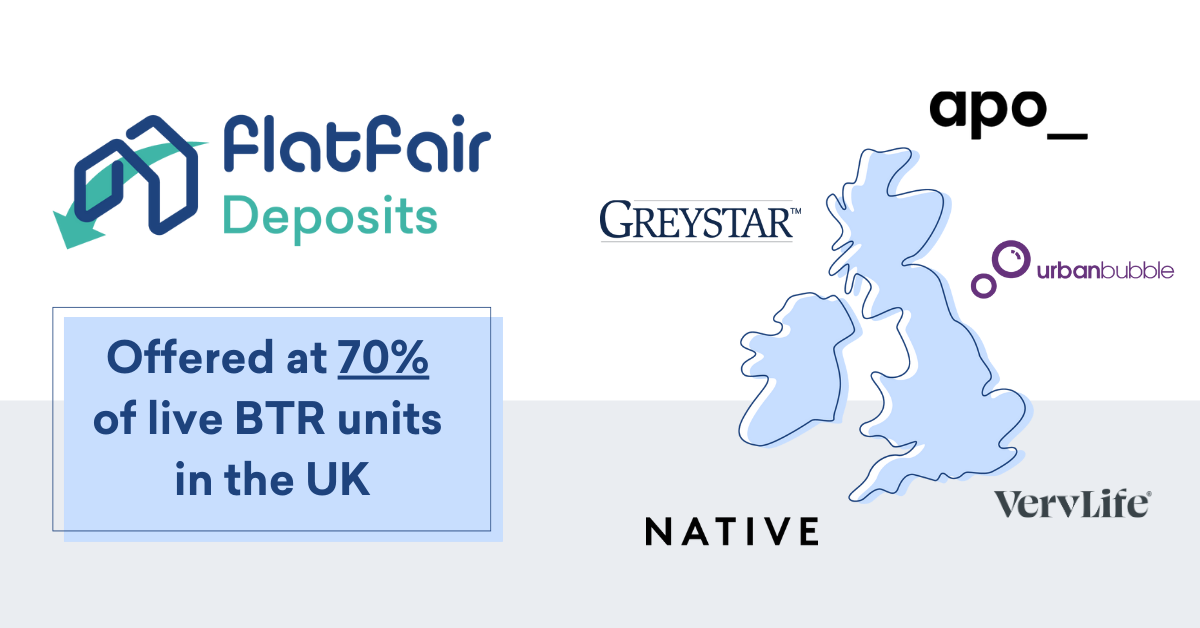

Property consultancy company Savills have released new data, stating there are 115,000 completed homes and our market-leading deposit alternative is offered at approximately 70% of live UK units.

We partner with more than 100 BTR operators in the UK, including many of the most renowned names in the industry: APO_, Greystar, Native Residential, Platform_, and urbanbubble.

There are a variety of reasons why flatfair Deposits is the go-to platform for BTR operators, from streamlining their operations, offering more choice to residents and providing extra protection at the end of tenancy.

A product like no other

flatfair Deposits is a unique deposit platform, combining traditional deposits with our popular deposit alternative, No Deposit. This enables operators to offer residents more choice while simplifying their deposit process.

At the start of the tenancy, residents are presented with the choice of both deposit options side by side, allowing them to choose what best suits their own circumstances.

Streamlining traditional deposits

If residents select a traditional deposit, our BTR partners save up to 60 minutes on administrative tasks per tenancy, as we automatically collect the payment via Open Banking and register it with their preferred deposit scheme.

By doing so, we remove the potential of human errors and missed deadlines in the deposit registration process, which can be worth up to three times the deposit amount.

As we partner with the major deposit schemes, operators do not need to switch from their current provider, ensuring no disruption to their existing processes.

Lower, transparent costs for residents

If their residents select flatfair No Deposit, they save an average of £1000 on their upfront move in costs by replacing a traditional deposit with a significantly lower fee of one week’s rent (+VAT).

Unlike other deposit alternatives, flatfair No Deposit is a one-off payment for residents, so there are no annual or on-going fees if they decide to extend their tenancy and stay in their property.

With the cost of living crisis continuing to escalate, tenants’ affordability is stretched. In July, HomeLet reported that rent prices, and therefore traditional deposits, are 5.2% higher than the same time last year. Which is why an increasing number of BTR operators are sourcing new and attractive offerings to support their residents, such as deposit alternatives.

Extra protection and speedy recovery of debts

With flatfair No Deposit, BTR operators also receive free market-leading protection for damages and/or rent arrears, which is double the protection offered with traditional deposits.

Using our handy online platform, operators easily can raise and negotiate charges with their residents directly to find a fair and speedy resolution. Once charges are agreed upon, our in-house collections team work to fully recover all debts owed to operators, so they can quickly reinstate their apartments before the next residents move in.

Ready to streamline your deposit process while offering a market-leading deposit alternative to your customers? Book a no-obligation demo with our team today.